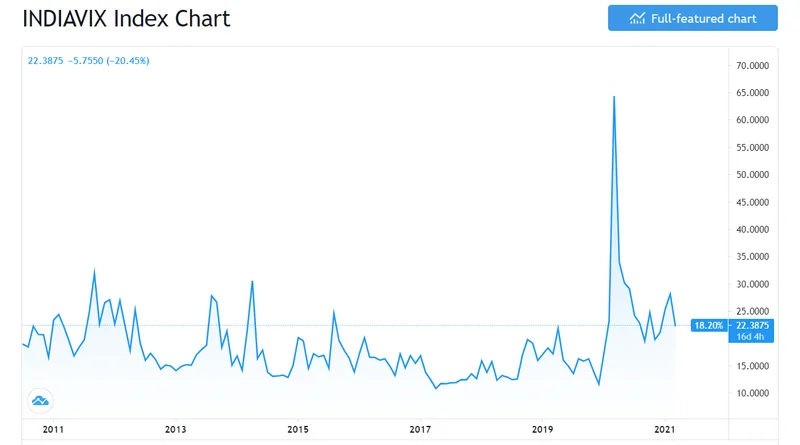

Okay, folks, buckle up. I know, I know, headlines are screaming "VIX SPIKES!" and everyone's reaching for their emergency exits. But let's take a deep breath and look at this from a different angle. The Cboe Volatility Index ($VIX)—Wall Street's so-called "fear gauge"—popped 19% recently, hitting its highest point since mid-October. But what if this isn't a sign of impending doom, but instead, the starting gun for a sprint towards a new era of innovation?

See, a high VIX usually means uncertainty. People are nervous, they're hedging their bets, and volatility [Keyword: stock market] goes through the roof. But uncertainty also breeds opportunity. It forces us to rethink, to re-evaluate, and, most importantly, to innovate. It's like a pressure cooker—sure, things get tense, but the result can be something amazing.

The Nvidia Mirage: A Wake-Up Call

Let’s talk about Nvidia [Keyword: nvda]. The stock [Keyword: vix stock] initially soared on a killer earnings report, easing fears about an AI bubble. But then, bam! It reversed course, dragging down the whole semiconductor sector with it. Now, some might see this as a sign that the AI hype is overblown. I see it as a much-needed reality check.

This isn't to bash Nvidia; their numbers were fantastic. But the market's reaction—the initial euphoria followed by the sudden pullback—tells us something crucial. We can't just throw money at AI and expect it to solve all our problems. We need to be smarter, more strategic, and more focused. We need real innovation, not just hype.

The Yahoo Finance Markets and Data Editor Jared Blikre joined Asking for a Trend and talked about market gains reversing, the US dollar and CBOE Volatility Index jumping, and bitcoin falling below $88,000 amid broader crypto carnage. This [Keyword: vix news] is an indication the market is in flux. Bitcoin & stocks fall, US dollar & VIX jump: Market takeaways

And this is where the VIX spike comes in. It's a signal that the market is demanding more than just promises. It's demanding tangible results, real-world applications, and sustainable business models. It's demanding innovation.

Think about it like this: the early days of the internet were filled with dot-com companies that promised the world but delivered very little. The bubble burst, and many of those companies went belly up. But what emerged from the ashes? Amazon, Google, and other giants that actually transformed the way we live. That's the power of a market correction—it weeds out the pretenders and makes way for the real innovators. The S&P 500 [Keyword: s&p 500] took a hit, yes, but it also opened doors.

Now, consider what's happening with interest rates. The Fed's next move is still up in the air. The chance of a rate cut at the December FOMC meeting jumped to almost 40%, then sharply declined from earlier numbers. Cleveland Fed President Beth Hammack even warned against cutting rates too soon, fearing it could fuel inflation and encourage reckless risk-taking. This uncertainty is like a crucible, forcing companies to become more efficient, more resilient, and more innovative.

And let's not forget the labor market. Initial unemployment claims are down, which is good news. But continuing claims are up, which suggests that people are having a harder time finding new jobs. This is a challenge, no doubt, but it's also an opportunity. It's an opportunity to invest in training and education, to create new jobs in emerging industries, and to build a more inclusive and sustainable economy.

When I first saw the market's reaction, I honestly felt a surge of excitement. This is the kind of shake-up that forces us to get serious, to stop chasing the latest fad, and to start building something that lasts. This is the kind of disruption that leads to real progress.

So, what kind of innovation are we talking about? Well, imagine AI not just as a tool for generating flashy images or writing marketing copy, but as a powerful engine for solving some of the world's most pressing problems. Imagine AI being used to develop new medicines, to combat climate change, to improve education, and to create a more equitable society. The [Keyword: vix index] is up, but so are the opportunities.

I saw a comment on Reddit the other day that really resonated with me. Someone wrote, "The market is just recalibrating. It's not the end of the world, it's just the beginning of something new." That's exactly right. This isn't a crash warning; it's the starting gun.

Of course, with great power comes great responsibility. We need to ensure that these new technologies are used ethically and responsibly, that they benefit everyone, not just a select few. We need to be mindful of the potential risks and unintended consequences, and we need to have open and honest conversations about the future we want to create.

This Isn't Fear; It's Opportunity Knocking

This VIX spike isn't a reason to panic. It's a reason to get excited. It's a reason to roll up our sleeves and get to work. It's a reason to believe that the best is yet to come. The VIX [Keyword: the vix] may be up, but the future is brighter than ever.