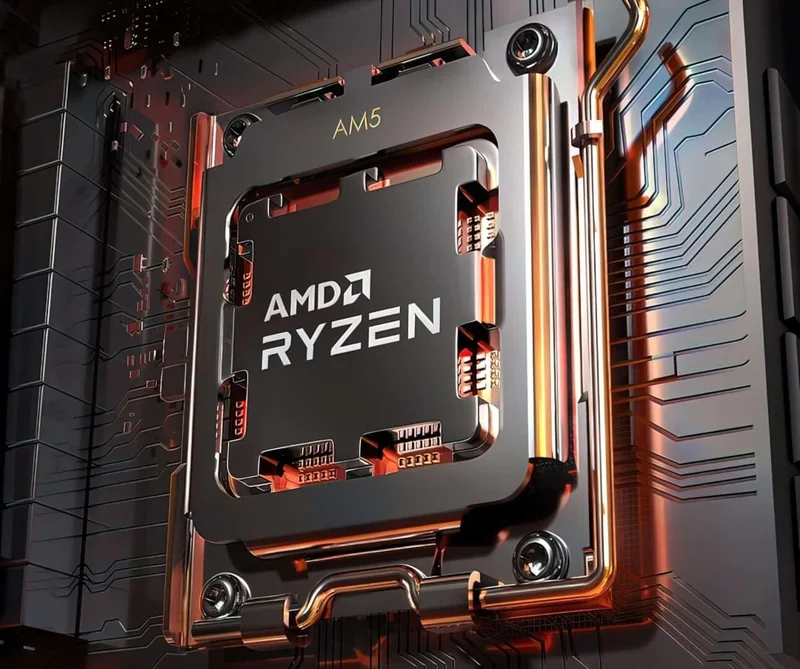

AMD just dropped its Q3 numbers, and the market's buzzing. Record revenue, strong Q4 forecast, and a future painted with AI gold, thanks to deals with OpenAI and Oracle. But let’s run the numbers and see if the story adds up.

The Headline Numbers

AMD reported $9.2 billion in Q3 revenue, which is undeniably a record. The forecast for Q4 is around $9.6 billion, give or take $300 million. Reuters pointed out that this is above the consensus of $9.15 billion. So far, so good. The data center segment, which includes the AI chip business, jumped 22% to $4.3 billion, exceeding analysts’ predictions of $4.09 billion. This segment is clearly the engine driving growth.

But here’s where the numbers get a little murkier. While AMD expects a solid 25% year-over-year revenue growth in Q4, the margin outlook is less impressive. CNBC noted that the 54.5% guidance only matches what analysts were already expecting. No upside surprise there.

The real question is: can AMD sustain this growth, and at what cost? The company is betting big on AI, but are these bets justified?

China and the 2026 AI Promise

AMD made it clear that the Q4 guidance doesn’t include revenue from Instinct MI308 shipments to China. CEO Lisa Su described the situation as "still fluid." They've got licenses for some shipments, but they’re still figuring out customer demand and market potential. They have inventory ready to go if the market opens up, but the scale of shipments will depend on demand. [News] AMD Forecasts Strong Q4 After Record Q3 Sales, Flags China and 2026 AI Chip Ramp-up confirms AMD's focus on navigating the complexities of the Chinese market for its AI chips.

This China situation is a wildcard. How much revenue are we talking about here? And what happens if those shipments don’t materialize? The lack of concrete numbers makes it difficult to assess the potential impact.

Then there's the 2026 outlook, fueled by the OpenAI deal. Su claims it could drive more than $100 billion in revenue in the coming years. That’s a huge number. But let’s break it down.

AMD is talking about 6 gigawatts of Instinct accelerators eventually. The initial deployment will be 1 gigawatt of MI450 GPUs in the second half of 2026. They expect the MI355 GPUs to continue ramping in the first half of 2026, with the MI450 series accelerating growth in the latter half.

Here's the part of the report that I find genuinely puzzling: the timeline. 2026 is a long way off in the fast-moving world of AI. What assumptions are they making about market demand, competition, and technological advancements between now and then?

And what about the cost? Lisa Su acknowledged that data center GPU margins usually improve as new products ramp, after an initial transition period. But she stressed that the focus is on boosting revenue and gross margin dollars, while gradually lifting the margin percentage. This sounds like they're prioritizing revenue growth over profitability, at least in the short term. Is that a sustainable strategy?

It's also worth noting that Su isn't providing full guidance for 2026 yet, but "based on current trends, we see a very strong demand environment heading into 2026." That's a statement of optimism, not a concrete forecast.

Is the AI Gold Rush Fool's Gold?

AMD is making bold claims about its AI future. The deals with OpenAI and Oracle are certainly impressive, but the company needs to execute flawlessly to deliver on these promises. The China situation adds another layer of uncertainty.

The market is clearly excited about AMD's potential. But as a former hedge fund data analyst, I've learned to be wary of hype. It's easy to get caught up in the narrative, but the numbers don't always tell the whole story.

AMD's Q3 numbers are strong, and the Q4 forecast is promising. But the long-term outlook is less clear. The company needs to prove that it can deliver sustainable, profitable growth in the face of rising competition and evolving market dynamics. Otherwise, the AI gold rush could turn out to be fool's gold.